CRE DealPRO MASTERMIND

Learn the Steps to Invest in Commercial Real Estate Like a PRO

A-Z STEPS TO INVEST IN CRE

University Access to Learn & Apply Systems & Formulas to Invest in CRE

EXCLUSIVE TIPS

Checklists & Resources to Scale Your CRE Portfolio

LIVE ZOOM CONSULTING

LIVE Monthly Mastermind Calls with Cherif Medawar (2nd Sat. of each month)

DEVELOP THE SKILLS TO TAKE ADVANTAGE OF THE

COMMERCIAL REAL ESTATE MARKET

- Not sure where to start. Do you think tapping into the knowledge you need is too expensive?

- Wondering if this is the right path for you?

- CRE DealPRO MASTERMIND is the most important training course & CONNECTION to one of the Nation’s most creative commercial real estate investors! It is a Network for the answers you need to get started or scale your business in this year. A MASTERMIND to analyze your deals, learn today’s trends and brainstorm to take your deals to the highest & best level.

- Get started in commercial deals, as we anticipate interest rates to rise and the market shift in 2025-2026.

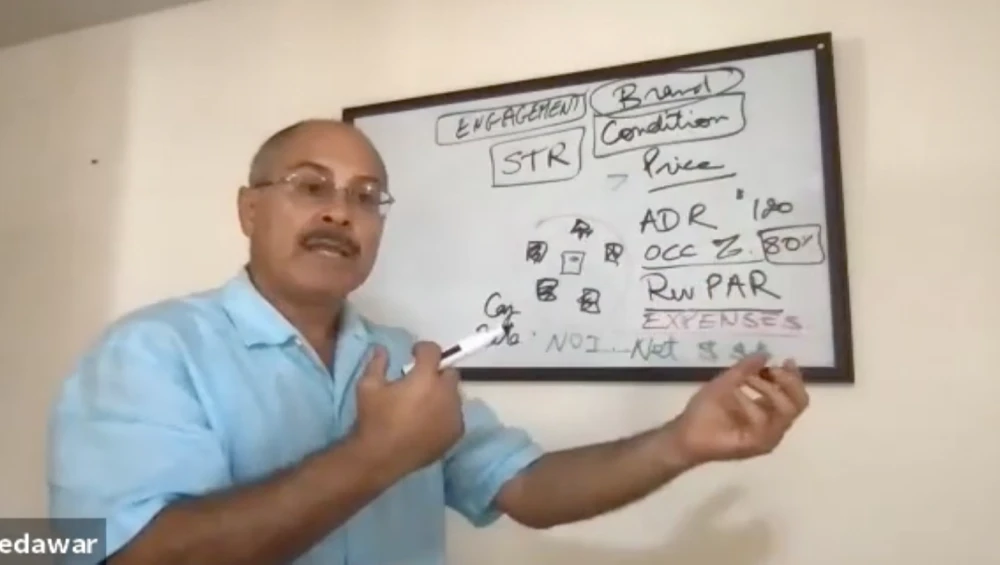

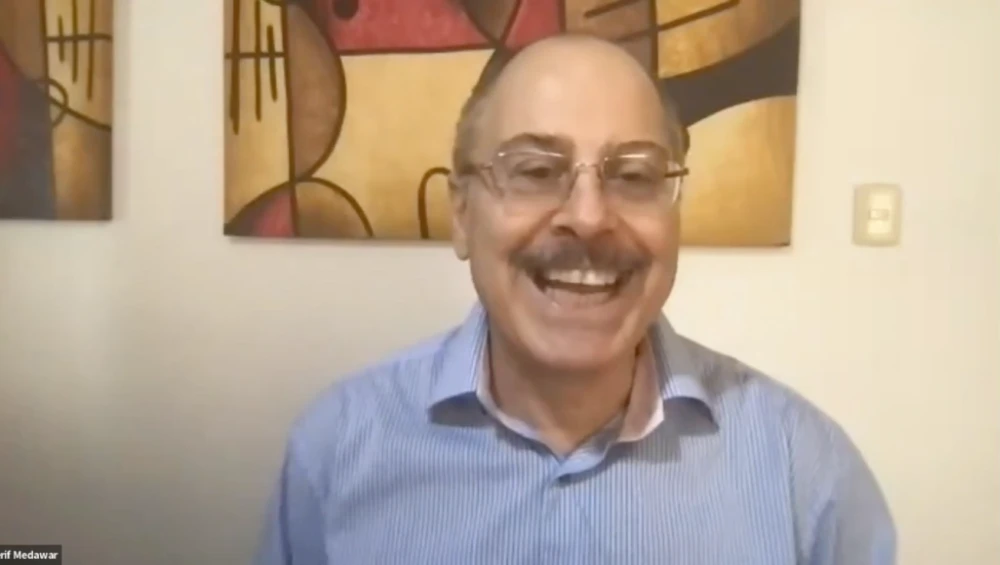

Cherif Medawar, Real Estate Fund Manager, Author, Instructor, and Investor is REVEALING his LATEST program, the CRE DealPRO Mastermind. This is a self-paced advanced online class on how to invest in commercial deals & raise unlimited capital, a live deal analysis, and a monthly platform to get all your questions answered by America’s most creative Deal Maker.

CHERIF IS READY TO TAKE YOU FROM SURVIVING TO THRIVING LIKE A PRO. JOIN HIM EVERY MONTH FOR HIS MASTERMIND!

Build A Foundation For Your Success In Commercial Real Estate Investing. We’re Here To Help Every Deal Maker Understand The Ins & Outs Of Commercial Real Estate Investing Through Education, Systems, Formulas, Collaboration, And Live Deal Analysis.

Why invest in COMMERCIAL REAL ESTATE NOW?

By joining the CRE DealPRO MASTERMIND

you will be informed about where the market is trending

and how you can put deals under contract.

We’ll track uncertainty around retail business operations and where the opportunity stands for you.

The CRE Trends

One of the key factors driving CRE trends today is the uncertainty surrounding which type of businesses will be able to withstand the post pandemic environment, inflation, and interest rates; and how this ability drives the values of those assets the businesses are leased up in. Businesses in strip malls, like coffee shops and hair salons, previously immune from fluctuations in the economy, are now at the peril due to inflation. But businesses like quick service restaurants, urgent care and pockets of national retailers are thriving. – CM

Behavior Of CRE Market

As we’ve seen in past down cycles, there is a massive reallocation of capital for investment to commercial sectors deemed safer with cash flows that are perceived to be more durable. 2025 is on track to follow this trend, as we see an increase in inventory. Look for pricing to tighten and competition to increase in multifamily, industrial& flex space, self-storage and medical sectors while loosening in retail, office, and hospitality. All wealth will be made in the STRUCTURE you, as an investor, put into play– CM

The Right Foundation And Education

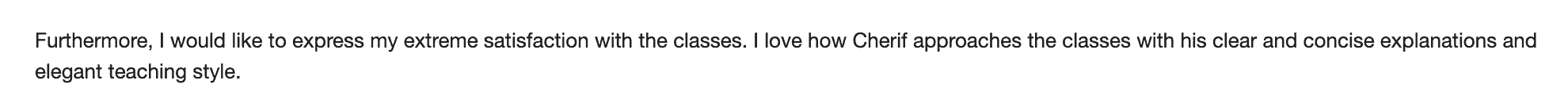

Cherif has been able to pivot quick & nimbly over the past 12 months, and he will train you to think the same. The first step is the foundation and education. In the course we will start with the definition, concept, and business model and then we apply the strategy. And then we will practice group thinking with Cherif leading the conversation to discuss capital reallocation and make sure your questions are answered so you are focusing on the right deals in 2025. Brainstorming and learning at the highest level the 2nd Saturday of EVERY MONTH! Learn, network and stay accountable.

GOT QUESTIONS?

BOOK A FREE PROGRAM CONSULTATION!

cherif says...

There are people telling you, ‘I’m going to make you rich, ‘I’ve got the solution’ and ‘I’ve got the answer,’ when they have never really done any deals themselves.

MEMBERSHIP BENEFITS

- CRE FACTS System for Success: A-Z Steps for Investing in CRE

- What Every Investor Needs to Know About Controlling Apartments & Multi-units: Manage the Asset Not the Drama

- The Power of Mixed-use Office Buildings: From Concept to Investment Reality NNN Opportunity with No Risk for Any Level Investor: Earn Passive Income in NNN Single Tenant Commercial

- The CRE Network and Profit Guide: Transform Your Investment Strategy for 2025 with Cherif Medawar

Checklists and Reports

CRE 100 Checklist

Report: The Power of Investing in Apartments

A Checklist for Buying and Selling Apartments

- Case Studies

- Checklist: Buying an Existing Business

- Checklist: How to Raise Capital

- Checklist: How to Flip Real Estate

- Closing Agreement

- Compliance Agreement

- Demand Letter

- Promissory Note

- Living Will

- Lease & Option

- LOI

- Marketing Emails

- Learn the DCBA Formula for Investing

- Learn the FACTS System

Properties and Tenants

Numbers and Market Trends

Negotiation and Contracts

Due diligence and Financing

Management and Increasing the NOI - Definitions

- Syndication, JVs & Partnerships (How the SEC works)

- Business Plan

- Consumer Debt vs. Business Debt

- Foundational CRE Concepts

- Portfolio Income

- Repositioning

- NOI/ROI/COCR

- Property Management

- Seller Financing

- Managing the Risk

- Calculating CAP Rates

- Negotiating with Sellers & Brokers

- Asset Protection

- Finding/Structuring

- CRE Asset Types

Apartments & Multi-units

Small, Boutique Apartments

Condo Conversions

Single Tenant Retail

ALFs & Senior Living

Storage Facilities

Mobile Home Parks

Land Development - 1031 Exchange

- Develop a Plan for Deal Flow

- Syndication

DCBA

Syndicator’s Responsibilities

Compliance

Ethics

Creative Deal Making - Real Estate Funds

- Crowdfunding

- Partnerships

- Joint Ventures

- Soliciting Investors

- Business Plan- The 5 P’s

- The Pitch

The Commercial Real Estate Roundtable (CRERT) forms the foundation upon which commercial real estate wealth is created. It is a new training format that is interactive learning at its finest. Through genuine examples and detailed strategies, Cherif will show you his proven strategies for all 12 types of property.

What’s in it for You

CREATE LASTING WEALTH THROUGH REAL ESTATE

Join the tens of thousand people achieving financial freedom through the power of commercial real estate investing. Would you like to pay your rent or mortgage for an entire year with just one real estate deal you can get under contract on a less than part-time basis? You will learn the proven strategy he used to build his own multi-million dollar business.

FIND AND ANALYSE

If you want to obtain the knowledge you need to FIND, and properly ANALYZE CRE Deals in your market, you need to take this course.

BECOME A CRE EXPERT

If you want to become an expert in putting CRE deals together, controlling the deal and negotiating like a pro with sellers and tenants you need to take this course.

FINDING THE RIGHT TENANTS

If you want to put one deal under contract, find the right tenant or tenants and start earning residual income within 90 days you need to take this course.

Cherif’s 2025 CRE MASTERMIND will focus on these asset types and any you bring to the table

One Commercial Deal will Change Your Life in 2025.

Success Oriented Team

Ready to Set You Up for

Success

Expert Training

Videos and Live, In-Person Events

Technology & Resources

To Automate Your

Business

Support

To Navigate the Commercial Real Estate Industry

With Cherif Medawar and his CRE DealPRO Mastermind,

you get the following:

Can You See The Power In This?

- Detailed strategy-based modules to learn at your own pace

- Checklists

- Business models to copy

- Top resources to use daily in your investing business

- Deal evaluation formulas

- LIVE deal analysis with Cherif

- LIVE updates to our new commercial real estate environment

- Access to Cherif for your investment questions

- Find New Opportunities in 2025

Who We Are?

Cherif Medawar Real Estate Investing presents to you the CRE DealPRO MASTERMIND. We are an investment and training company lead by a Real Estate Fund Manager who has developed a simple strategy that can be implemented on any type of asset investment. He applies his strategy when investing in all asset types, commercial and residential. He’s earned millions of dollars investing in single-tenant retail, and now he’s focusing on small boutique apartments, hotels, and development projects. Cherif Medawar has been teaching investors, just like you, for over 30 years. He wants to help you attain financial freedom in only 3-5 years. You must start now and learn the foundation of investing in CRE like a PRO.

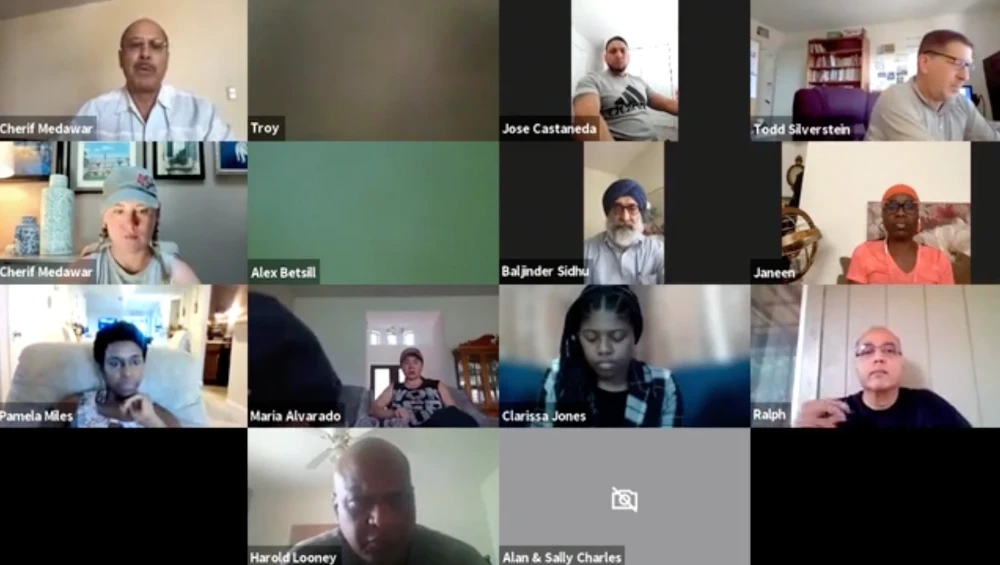

Here’s What Cherif’s Students Are Saying