Commercial Real Estate DealPRO Mastermind #17

February 08, 2025

Join us for an insightful mastermind session with real estate expert Cherif Medawar as he tackles commercial real estate investing strategies, lease options, 1031 exchanges, build-to-suit opportunities, and navigating market shifts in 2025.

Antonio., CA

1.I am considering investing in standalone buildings. One of your success stories is a teacher who invested in a convenient store. Is 7-11 gas station model still expanding in northern California? 1:01pm

When looking for these deals are we focused on the gas station part and the retail? Or just retail? 1:03pm

- What questions should I ask the seller when I find this type of deal? 1:04pm

Amal S., NJ

(JV Partner)

Many of our successful friends submit completely lowball offers, and that has been an extremely successful strategy for them. We are building relationships with brokers and with sellers directly (for off market deals), and wondering how do we balance preserving the relationship and keeping our options open for down the road, in the case a seller’s motivation changes, with the risk of upsetting them so much that they turn off from us? The question is for both brokers and sellers.

PeterR., WA

- Can you give me your experience on Lease Options? What pitfalls should I look out for? And what is your opinion—areLease Options are better than Sub 2?1:12pm

- What are 10 things I should as the broker when buying an office building? 1:22pm

- If I would like to work with you to review a contract and get ideas to work the deal, can we talk? How do I organize that? 1:30pm

(Cherif- I found this guy talking about Office buildings:https://youtu.be/swvf6JvpS6Q?si=vD6LaJ0qSZQJcx-a)

Follow up: Soojin 1:30 pm

Zayida B., FL

(JV Partner)

Question about a former McDonald’s (3600 SF) that has been vacant for a while. There’s a restriction on the land barring any food-related usage. In addition, a CBD dispensary was also recently barred. Could you suggest any non-QSR uses, categories, or specific tenants? 1:31pm

Mark V., MI

Multiple retailers filed for bankruptcy and/or went out of business in 2024. Big Lots, LL Flooring (Lumber Liquidators), Walgreens and Party City, to name a few, are in the process of shuttering locations. Do you think the pending vacant space provides opportunities for other retailers’ expansion plans? 1:34pm

(Cherif- interesting article: https://www.globest.com/2024/12/20/leveraging-lessons-from-the-downturn-retail-real-estate-experts-share-key-takeaways-for-2025/?slreturn=2025020133551)

- Are there any tax incentives in commercial? What are they and how can we take advantage? 1:38pm

Mohammad E., CA

Please explain what a NNNN lease is and your top tricks to negotiate such a lease. Can we do this in any type of commercial deal? 1:51pm

Daniel S., FL

- What are promising asset classes to focus on? What is the net lease investment market? 1:56pm

(Cherif, I found this: https://www.linkedin.com/pulse/building-resilience-how-thrive-2025-net-lease-market-parks-ccim-84xje/)

Shawn K., VA

- What type of investors should invest in commercial real estate? I would like to know so I can find CRE deals and assign, flip, wholesale to these people.

Paul R., CA– interesting for newsworthy conversation online related to the CA fires

- How can we work with the aftermath of the CA fires in LA and surrounding markets? What opportunities are there for investors? How can we reach out about these CRE buildings? What is the pitch? Should we contact tenants that lost their business?2:16pm

- How do we do a build to suit as there is alot that needs rebuilt?

3. Will the local government be involved in redevelopment of the area? 2:24pm

Clint M., TN

- Is the Lock-In Effect Breaking? As more sellers finally come to market, we’re seeing the biggest listing surge in two years. Is there an actual shift or is it manufactured? Could this be opportunity for investors? What do I need to be on the look out for and what do I need? 2:28pm

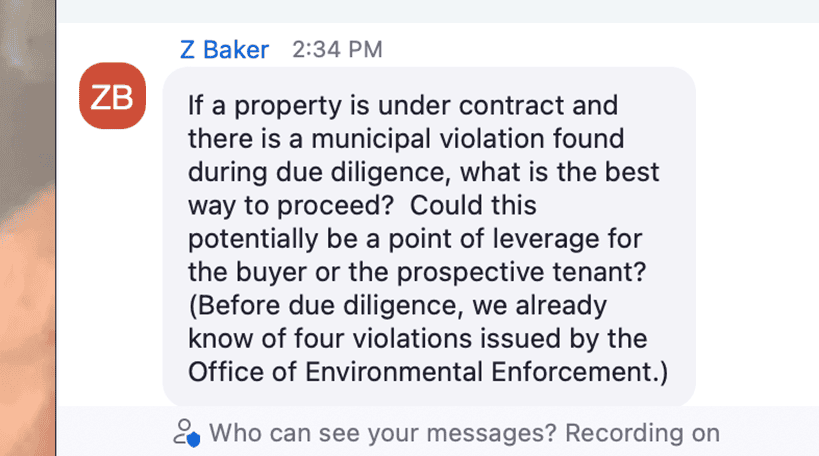

Edgar follow up question: 2:30pm

Seun’s follow up: 2:33

- I am considering Setting up a RE Fund and I need to do some estate planning. If I want to set up a Fund but may be going through a divorce how do I protect it from being part of the settlement? 2:34pm

(Cherif, let everyone know you are starting a live training on February 4th and these people can attend for only $199. Explain they can get into the training at that price TODAY only as we are sending all the info out tomorrow for people to prepare for the Tuesday event.)

Zayida’s follow up: 2:37pm

HOW NOT TO GET OVERWHELMED? CHERIFISM OF THE DAY. 2:48pm

The principle of efficiency. 2:49pm

FINAL TOPIC IN CLOSING:

Please expand on your thoughts?

- JUDGEMENT

- HOW TO DETERMINE WHEN TO TAKE ACTION