Commercial Real Estate DealPRO Mastermind #14

September 14, 2024

Creative Real Estate Strategies: Unlocking Opportunities with Data Centers, Tenant Negotiations, and Sequential Thinking

Paul G., CA

(JV and potential Fund Manager)

1:00 PM

IshonM., FL

(JV)

- When assigning over a purchase contract to a tenant what do you tell the tenant who wants 60 days to get construction documents and 90 days to get permits before closing? I have 45 days for due diligence and 15 days to close…1:03 PM Cherif gives an ABSOLUTE STATEMENT for negotiating.

- When assigning deals to assignees is it better to have a letter of intent to lease already negotiated or let the assignee negotiate the loi with the tenant? 1:08 PM

- What if corporate doesn’t have an area franchisee. Would you/Migsif be still open to getting a franchise license? What would you need to know about the deal & tenant? 1:10PM

- Could you talk about thinking in sequence? 1:14PM

- Besides starting a real estate fund, What are three things you wish you knew regarding commercial real estate when you were in your 20s? 1:17 PM

DanielS., FL

(Vet & a JV in South FL)

- What guidance do you have for a busy professional to make time for investing and running a practice and managing a busy family life? 1:21PM

Maggie F., CA

I’m currently in discussions with a broker who has presented me with several vacant properties he has for sale. Four of these properties are within 10–15 minutes of each other, while one is about an hour away. These were previously Wendy’s locations, but they are now vacant due to the bankruptcy of the previous franchisee/franchisor.

All properties have excellent neighboring tenants, ad each location boasts traffic counts of over 50,000 vehicles per day. The broker has also provided me with comps and previous rental data for all the locations.

I’m concerned about potentially missing out on a good deal due to uncertainty on where to start.

As we can only place one property under contract at a time, I would appreciate your input on how to approach selecting the first location.

Should I inform the broker that we are focusing on one location for now, Alternatively, would it be wise to make verbal offers on all properties to explore the broker’s flexibility?

Please let me know your thoughts, 1:26 PM

1:29 PM

1:30 understanding the politics and the problems to adjust

1:39PM

Alex M., TX

Hi cherif, I have seen the inside of the property of a deal & was thinking of submitting an LOI with my offer.

I have just seen a few more deals online in my area that are great as well, can i do 3 deals at once if i have more than enough EMD for All of them? I wouldn’t want to lose them to a competitor & it’s taken off the market.

Daryll C., CA

(JV)

- Would we use a NNN sf per sq ft or Gross price per sf? (For example, 0.46/SF NNN or $1.65/SF/Month Gross. Which lease rate to use for this calculation?)

- Would this formula work for any condition? If the property needs more work like needs a complete remodel vs just dated? If so, how would you calculate to formulate your offer? 1:45 PM

3.Is there any other specific criteria about a property that you would not submit an offer using this formula? 1:57 PM

- How do you frame your offers?

1:47 PM

1:53 PM

What are the ways to increase your luck factor? 2:02PM

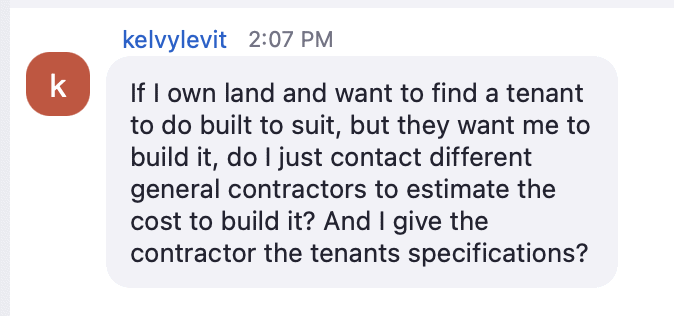

Nick S., GA

(CRE DealPRO)

- I noticed some brokers mention that it is at the discretion of the buyer to verify restrictions/exclusives for the buildings, How can I verify any deed restrictions for the potential uses of a building? 2:03PM

- How do we know how much to offer in tenant improvements on a medical suite? How do I calculate that into the deal? 2:05PM

- How would you use TI as a negotiation strategy without getting taken by the potential tenant? Can I finance that into the loan? Does that make sense in the over all deal and how do I calculate that? 2:08 PM

2:12PM

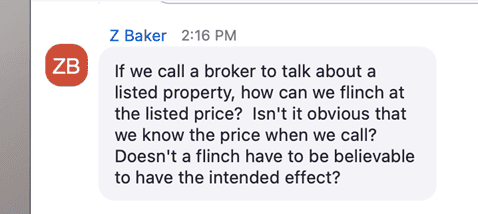

2:15 PM

2:28 PM

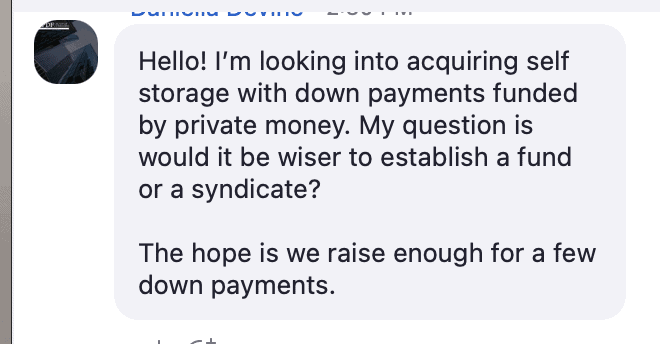

Kristal W., SC

(Potential RE Fund Manager)

- Do I need to invest my own money in the fund? Or do I invest my money outside the fund? 2:29PM

- How do you identity deals and conduct due diligence and make investment decisions? 2:31PM

- What are your thoughts about the current political landscape and investing? Should I wait until after the election? 2:36PM

2:41 PMuse for Cracking the Code marketing

2:42 PM

Charles P., MN

(JV). 2:38 PM

I’m looking at investing in my first commercial deal. Do you think car washes are a good asset class?

How do you even begin to calculate if this is a good deal?

A Four Bays Car Wash, could be up and running with little upgrades or could be removed and replaced by QSR or another retail option. (when it was in operation NOI exceeded six figures) or could be converted to retail with multiple tenants.

More than 27,000 cars per day travel through that site.

Asking price $1,100,000.00.

2:46 PM- use for Cracking the Code marketing

MikeZ., MI

- How to manage difficult tenants professionally and legally? In a long term residential scenario or a business lease scenario? 2:48 PM (Performance bond for tenants)

Peter C., NM

- What key questions for a buyer of aapartment in a mixed-use project?

I’m looking in New Mexico. 2:55 PM

Damon W., CA

I met a business owner looking to move from one warehouse space to another. I have the opportunity to find a building for them. What strategies do I have to work myself into the deal and make money? I do not have a lot of capital to start with. They are in San Diego county. 2:56PM

2:59

Mohammad E., CA

(JV- he’s been training with you for many, many years. He started in the ICRE days)

In preparing for tomorrow’s meeting, I want to request some inspiration and push to take the next step after identifying the properties because personally speaking I have some properties but do not have the required confidence to submit an LOI and lock the properties. I need some sort of confidence building support!

- a) I have spoken to the listing agents regarding the properties identified by me and taken videos of the premises, noted down the neighbors in the vicinity of properties, gathered all the required information> I summed up the required information in the attached XL sheet so I do not miss any vital information.

- b) I have watched the videos many times and also have read the script at University website many times but still get “no confidence” to take the next step

Thanks for your guidance. 3:09 PM

FINAL TOPIC IN CLOSING:

Explain Health Wealth & Happiness 3:13 PM