Commercial Real Estate DealPRO Mastermind #12

July 20, 2024

Developments vs. Flipping: What’s the Best Approach in Today’s Market?

Travis G., TN

1pm EST

- I’ve seen a few vacant pizza hut buildings, with 1 being a land lease. Are they worth trying?

1:02pm

- How do you control a property that will be a potential lease with an option? STB & other commercial properties.

1:06 pm

- What has been the fastest method to finding Single tenant buildings for sale thus far in the JV program?

Marsha M., CA

1:07pm

- Can you explain what type of lien is set up to strip equity from my 3 rental properties for asset protection. Does this help with estate planning as well?

1:13pm

- I have an existing Living Trust. Do I need to move the properties owned in my name to the Trust name? Re-deed?

1:19pm

- Can I protection my options account with a UCC1?

1:21pm

- What happens if I’m sued and go to a jury or judge?

Tyson S., IN

1:24pm

- Can you please simply explain the two concepts of how to value real estate based on price per square foot and also the concept of buying below placement cost? Having trouble understanding them.

1:28pm (1:30pm getting permits- DISASTER- measure effort and risk- 3 challenges- money gives you shortcuts- live/balance)

- When completing a ground lease with a national tenant, are there any additional costs besides just buying the vacant building/land…if you can’t give them a Tenant improvement/allowance is there a way to still complete the deal?

Kyle M., NY

($97 Try Before You Buy)

1:34pm

- Do you have a formula or strategy for buying residential deals in this current market? I’m having real issues deciding how to analyze deals being sold FSBO or on auction?(Cherif for 5 things for residential-Plan A, B, C)

1:39pm

- How low to market should I be giving myself as a cushion? (General Rule- best rule of business “don’t look too smart”- essence of becoming wealthy 2Things)

I’m very nervous but don’t want to miss out on this so called buyer’s market?

1:42pm

- What is your overall feedback on developments vs flipping existing homes? (What kills you are the delays)

1:48pm (Huge for discussion on the market)

- What type of commercial should I keep an eye out for? (He talks about hotels, connect this to the next hotel commenets)

Mohammad E., CA

(NEW JV in Anaheim- he’s been a student of yours for 10 years)

1:54pm

- There is a second generation restaurant space for sale in Jurupa Valley, CA but the listing broker is not willing to give me the CAP rate for the area or the Potential rent. So, what should be the next step?

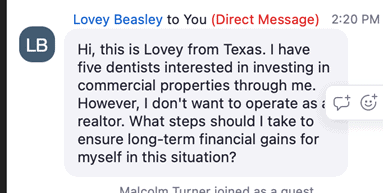

1:57pm LOVEY’s follow up cap rate question+ he gives a case study with Guess

2:02pm

I am a Realtor and when submitting LOI do I have to declare that I am a realtor, or my broker has to be involved before I take any step towards LOI etc.

2:03pm

- There are couple of properties which meet the property requirements and criteria, but the owners are not willing to sell these and these are available only for LEASE. What should be the next step? (They are not willing to invest NOW… things change. Once you put a seed in someone’s mind…)

2:07pm

- Is it possible to seek your help in reviewing a property once all “needs” criteria has been met. Personally, speaking I am scared to submit an LOI and then not getting anywhere. Need your help and guidance to the right direction. I really have no problem with sharing a percentage of the deal proceeds with CMREI if I can get some type of hand-holding help!(CUT THIS FOR THE JV SITE and for JV marketing efforts)

Karl P., CO

(RE Fund Manager & JV)

2:10pm

- Does the shape of a one acre lot matter when making an offer on land to bring in a QSR for build to suit? For example, a rectangular lot as opposed to a square? (RULES FOR LOTS& a bonus, great reel)

2:15pm

- How will the new real estate law over commissions affect the way investors do business starting in August?

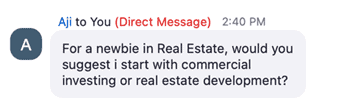

2:21pm Follow up question from Daryll

2:23pm

2:26pm (Use this for the Solve Your Cap marketing.)

- What is the rate for a wealth management company that wants to invest in a fund? Will that be 4% percent or fund manager’s discretion depending on how much the management company will invest?

Tim C., FL

2:28pm

- What are the worst markets to stay away from now and the best markets to focus on for commercial multi units?

2:30pm

- How are you feeling about apartments right now? When should we start putting out offers?

2:31pm

- Do you think converting office to apartments or assisted living is a good move. How would you analyze the deal? (All good investing starts with the analysis of risk.)

2:34pm

- Do you think Miami is overpriced? (The question- How do you FIND your deals)

2:39pm

- What are the problems with hotels.

Aji- 2:43pm

Ivan- 2:44pm

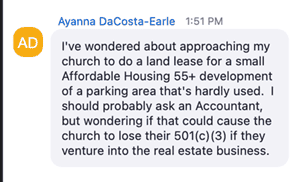

Ayanna- 2:46pm

Ishon M., FL

(JV)

2:48pm

- What is the best way of managing your money? (12 Steps, should be a reel)

2:55

- What is the best way to structure a deal with a seller when I have tenant who wants to purchase and needs 90 days dd and 15-30 days to close?

(Add in Mark B’s testimonial)

ElleJ., GA

2:57

- Do we need to file BOI Reports for all entities or just a business that is up and running?

- Can I do this, or should I use an attorney?

Vic M.,

3:03pm

Do you know how to calculate profit and loss on an investment?

I invested $500K to buy a condo- I rented it at $4K a month- my association fees are

$500/mo. – sadly the tenant did not pay after a while and – It took me 6 months to get

him out- I had to fix up the place and then it took me a while to re-rent it.

Total rent period over 36 months was 26 months- at $2K a month I received $104k minus

the association fees $18K and other condo expenses including rent commission and

repairs $6K. If I sell the condo today to liquidate, can I win

after closing and commission.

James B., MN

I have been participating in your series of zoom training on creative RE structure. I know we have 2 more training calls, but I have a few questions. By the way this is the best training information and real info I have received yet. I have taken a seminar and a conference, and nothing has compared. And you were so real about the “reality” of raising to institutions. I greatly appreciate this because it’s the opposite of what all other trainers and so-called hedge fund managers have been telling me. I’m a Broker and really want to capture the investors in my current client list- and believe this is the way. I may/may not be on the call because I work on weekends. Hope I make it.

(This is a huge video for reels and the landing page for the Cracking the Code campaign)

3:06pm

- The pros & cons of managing a Fund?

3:07pm

- What are the overall financial benefits?

3:11pm

- Can I pass on the depreciation in a multi-unit deal to my investors? Or partners? How can I share the tax breaks to get people to invest with me?

3:12pm

- How much reserve should I NOT deploy and hold on the side for payouts? How do I float that?

3:15pm BEST WAY TO HOLD RESERVES

3:16pm

- If a debt fund operator keeps the upside after paying the investors each payout how do you manage that money? Do you reinvest? Do you use your profits for construction? Do you just keep the money? I’m not understanding how to manage that money. Advise.

Daniel S., TX

3:18pm

- You mention “Exchange of value is the key thing in life.” Can you explain. I have a business and find it harder and harder to fund good employees. Looking for some inspiration here.

Exchange of value. He really covers some amazing content here.)

3:32pm (The 4 Ds)

- How do you manage work/professional goals and day to day responsibilities?

3:36pm

- Do you advise to partner with family or friends?

Gabe C.,VA

($97 Try Before Your Buy)

- Do you partner on commercial deals or work with wholesalers?

3:43pm

- What do you do when you think you reached the top and hit your goals?

FINAL TOPIC IN CLOSING:

Explain what “matters”.